When you fill a prescription for a brand-name drug like Protonix or Yasmin, your insurance might not cover the brand version at all - but it could cover the exact same pill with a different label. That’s an authorized generic. Unlike regular generics, which are made by different companies after the brand’s patent expires, authorized generics come straight from the original manufacturer. They’re chemically identical, same ingredients, same factory, same quality. But they’re sold under a generic name and at a generic price. And for insurers, that’s a big deal.

What Exactly Is an Authorized Generic?

An authorized generic is not a copy. It’s the real thing - just without the brand name. The FDA defines it as a drug approved under the original New Drug Application (NDA), sold under a different label, packaging, or barcode. For example, if you buy the brand-name version of Synthroid, you get a white tablet with the word "Synthroid" on it. The authorized generic? Same tablet. Same active ingredient. Same inactive ingredients. Just labeled "levothyroxine sodium" and packaged in plain white bottles. This matters because traditional generics have to prove they work the same way through expensive bioequivalence studies. Authorized generics skip that step entirely. They’re made under the same NDA, so they’re automatically considered identical by the FDA. That means no uncertainty for doctors or patients. No need to worry about whether the generic will act differently in your body. As of 2023, there were 147 authorized generics on the FDA’s official list. Most are in high-use categories: heart meds, thyroid drugs, birth control, and antidepressants. But only about 15-20% of brand-name drugs even have an authorized generic version. That’s because the brand manufacturer has to choose to make one. And sometimes, they don’t - especially if they’re trying to protect their market share.Why Insurers Love Authorized Generics

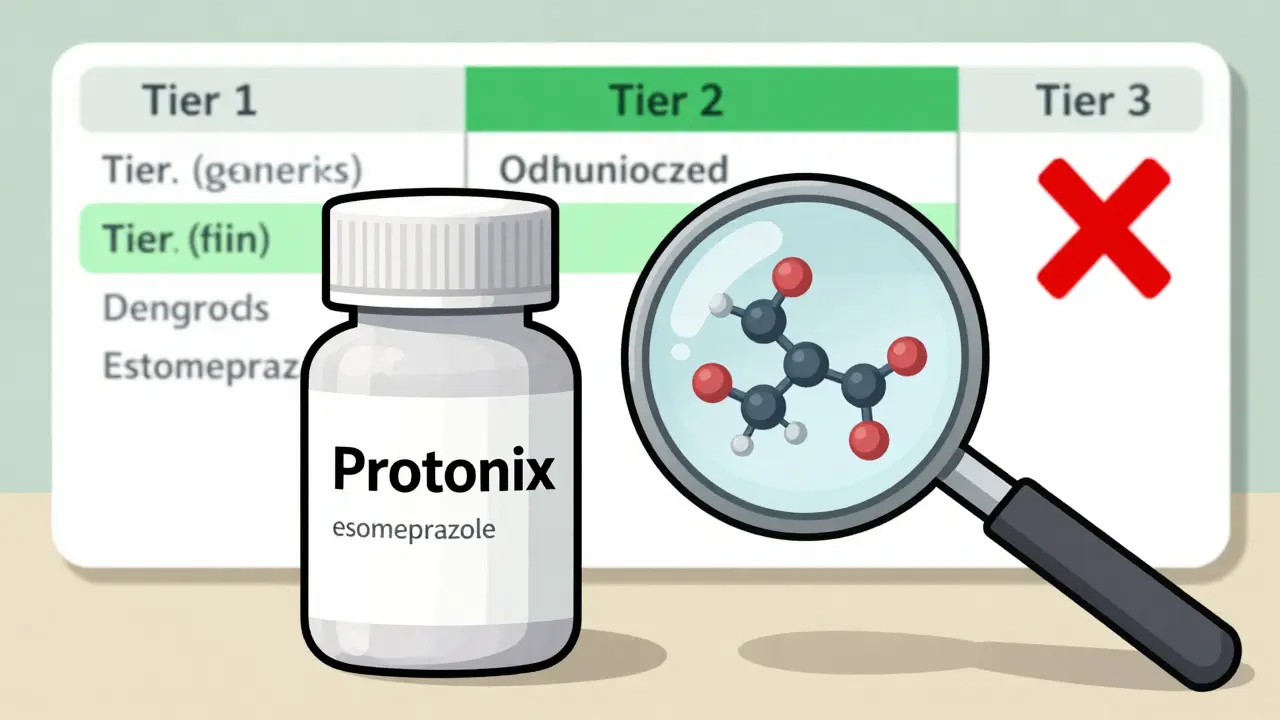

Insurance companies are under constant pressure to keep costs down. But they can’t just swap any generic for a brand drug. If a patient is on a medication with a narrow therapeutic index - like warfarin or lithium - switching to a regular generic can be risky. Even tiny differences in absorption can cause side effects or treatment failure. Authorized generics solve that problem. They’re not just cheaper. They’re safer to switch to. And that’s why 87% of Medicare Part D plans put them in the same tier as traditional generics - usually Tier 2. That means a $10 or $15 copay instead of $50 or $100 for the brand. A 2022 study of 1,247 Medicare Part D plans found that plans with clear policies for covering authorized generics saved 7.3% per member per month on prescription costs. That’s not small change. For a plan covering 100,000 people, that’s millions saved in a year. And those savings aren’t just for insurers. Patients pay less. Pharmacies get paid faster. Everyone wins - except maybe the brand manufacturer, who loses some revenue.How Formulary Placement Works

Most insurance plans have tiers. Tier 1 is the cheapest - usually old-school generics. Tier 2 is newer generics or authorized generics. Tier 3 and 4 are brand-name drugs. Some plans even have Tier 5 for specialty meds. Authorized generics almost always land in Tier 2. Why? Because they’re priced like generics but perform like brands. Insurers don’t need to require prior authorization or step therapy for them. They’re treated like any other generic - except they’re more reliable. But here’s the catch: not all pharmacy benefit managers (PBMs) treat them the same. Some still list them as "brand equivalents" in their systems. That can cause confusion. A pharmacist might see the NDC code for an authorized generic and think it’s the brand - and then deny coverage because the patient hasn’t tried the cheaper generic first. That’s why PBMs like OptumRx and Express Scripts have started adding special flags to their systems. In 2022, Express Scripts added a dedicated identifier for authorized generics. In January 2023, OptumRx launched an "Authorized Generic First" policy for 47 high-cost drugs. That means if an authorized generic exists, it’s the default covered option - no exceptions.

What Patients Experience

Patients often don’t know they’re getting an authorized generic. The pill looks different. The bottle says something else. They might panic. Or worse - they might not notice at all. A 2022 GoodRx survey found that 34% of patients were confused when their pharmacy switched them to an authorized generic without telling them. Eighteen percent had their claim denied at first because the system didn’t recognize the NDC code as a covered drug. One Reddit user, u/MedicationWarrior, shared: "My insurance denied Synthroid but approved the authorized generic with a $10 copay. I didn’t know it was the same pill until I checked the label. Saved me $40 a month." But not everyone has that luck. Some patients with allergies to certain dyes or fillers - even if they’re the same in both versions - get nervous. They’ve been on the brand for years. They trust it. Switching, even to an identical drug, feels risky. That’s why transparency matters. Pharmacies should tell patients when they’re getting an authorized generic. Prescribers should be trained to write prescriptions that allow for substitution. And insurers need to make sure their formularies clearly list authorized generics as covered options - not buried in fine print.Challenges and Gaps in Coverage

The biggest problem? Availability. Only one in five brand drugs have an authorized generic. That means for many medications - especially newer ones or those in oncology - patients don’t have this option. Another issue: identification. Authorized generics aren’t listed in the FDA’s Orange Book, which is where pharmacists usually look up drug equivalencies. Instead, they have to check the FDA’s separate authorized generic list - which isn’t always easy to find or update. Walgreens reported a 12% error rate in processing these claims in 2022, before they added special verification tools. Some PBMs, like Prime Therapeutics, have built their own databases - AG Tracker - that pull in all authorized generics and update them in real time. As of Q2 2023, it covered 98% of available products. But not every pharmacy or insurer uses it. And then there’s the elephant in the room: market manipulation. Critics like Dr. Peter Bach argue that some brand manufacturers use authorized generics to block real generic competition. By launching their own generic version right when the patent expires, they squeeze out smaller generic companies that can’t afford to compete on price. The FTC flagged this in a 2022 report, saying it slows down true competition in 22% of cases studied.

What’s Changing in 2025

The Inflation Reduction Act of 2022 is pushing more authorized generics into Medicare Part D. CMS estimates that by 2025, coverage will increase by 15-20% as part of efforts to cap out-of-pocket drug costs. That means more patients will see these drugs on their formularies. Employers are catching on too. According to the Kaiser Family Foundation’s 2023 survey, 68% of large employers plan to treat authorized generics differently than traditional generics in their 2024 plans. Some will make them the preferred option. Others might even offer lower copays for them. The FDA’s new GDUFA III rules, effective in 2023, are making it easier to track and report authorized generics. That means better data, fewer errors, and faster updates to pharmacy systems.What You Should Do

If you’re on a brand-name drug and paying a high copay:- Ask your pharmacist: "Is there an authorized generic for this?"

- Check the FDA’s authorized generic list - it’s public and free.

- If your insurance denies it, ask them to verify the NDC code. Sometimes it’s just a system glitch.

- If you’re switching from the brand, ask your doctor to write "dispense as written" if you’re concerned about ingredients.

- Update your formulary system to flag authorized generics separately.

- Train staff to recognize them - they’re not the same as traditional generics.

- Include them in tiered formularies at the same level as other generics.

- Don’t treat them as brand-name drugs. They’re not.

Drew Pearlman

January 9, 2026 AT 21:20Man, I had no idea authorized generics were just the exact same pill with a different label. I thought generics were always cheaper knockoffs. My mom’s thyroid med switched last year and she freaked out until I showed her the FDA list. Same factory, same chemist, same everything. It’s wild how the system hides this from people on purpose.

And the fact that insurers save millions while patients pay less? That’s the kind of win-win that should be shouted from the rooftops. Why aren’t pharmacies required to say, ‘Hey, this is the brand but cheaper’? It’s not just about cost-it’s about trust.

Meghan Hammack

January 10, 2026 AT 04:23THIS. I’ve been telling my clients this for years. I’m a pharmacy tech and I see people panic every time their pill changes color or shape. They think it’s a different drug. But if you just tell them ‘this is the exact same thing your doctor prescribed, just cheaper’-they calm right down.

And yeah, the NDC code mess? So real. I had a guy cry because his insurance denied his Synthroid. Turned out it was the authorized generic. We had to call the PBM three times. They didn’t even know what they were denying.

Just say the words: ‘Same pill. Different label.’ It’s magic.

RAJAT KD

January 10, 2026 AT 11:58Authorized generics are not generics. They are the original product. Stop calling them generics. This confusion is deliberate.

Angela Stanton

January 12, 2026 AT 07:05Let’s not pretend this is altruistic. The pharma giants use authorized generics as a predatory tactic-launch their own ‘generic’ to crush real competitors before they even get off the ground. FTC’s 2022 report showed 22% of cases where market entry was blocked. This isn’t patient care-it’s corporate chess.

And don’t get me started on PBMs like Express Scripts. They’re not ‘helping patients’-they’re just shifting costs from one pocket to another while taking 15% cut. The ‘savings’ are illusions wrapped in white bottles.

Aron Veldhuizen

January 12, 2026 AT 21:24You all are missing the real issue: why does the FDA even allow this? If a drug is chemically identical, why does it need two labels? Why is the brand-name version still sold at $120 when the ‘generic’ version is $15? It’s a legal loophole disguised as consumer choice.

The system isn’t broken-it’s designed this way. The FDA, PBMs, and manufacturers all benefit from the confusion. Patients? They’re the ones paying in anxiety, time, and out-of-pocket costs.

And don’t tell me ‘it’s cheaper’-it’s only cheaper because someone else is being gouged. The brand manufacturer loses revenue? Good. They’ve been gouging us for decades.

This isn’t transparency. It’s theater. The pill is the same, but the power structure isn’t. And until we fix that, no amount of ‘authorized’ labels will make this fair.

Johanna Baxter

January 14, 2026 AT 00:04I switched to the authorized generic for my antidepressant and my insurance denied it because ‘it’s not on the formulary.’ I called them. They said ‘we don’t cover that.’ I showed them the FDA page. They said ‘we don’t recognize it.’ I cried. Then I screamed. Then I got a letter saying ‘we’re sorry, we’ll cover it next month.’

WHY IS THIS SO HARD?? I just want my medicine to not cost my rent.

😭

Ian Long

January 15, 2026 AT 22:18Look, I get the anger. I really do. But the fact that we’re even having this conversation means progress is happening. Five years ago, no one knew what an authorized generic was. Now we’re talking about formulary flags, real-time databases, CMS pushing for inclusion.

It’s messy. It’s bureaucratic. But it’s moving. The fact that OptumRx and Express Scripts are updating systems? That’s not nothing.

Yes, pharma is gaming the system. Yes, PBMs are shady. But if we focus only on the villains, we ignore the people fixing it-pharmacists, patient advocates, even some insurers who actually want to do right.

Change doesn’t come from rage. It comes from persistence. And right now, we’re being persistent.

Lindsey Wellmann

January 16, 2026 AT 06:28OK but imagine this: you’re on your 10th refill of your brand-name pill. You open the bottle. It’s a different color. Different shape. No logo. You panic. You Google it. You find out it’s the SAME THING. But your insurance didn’t tell you. Your pharmacist didn’t tell you. Your doctor didn’t tell you.

That’s not a win. That’s a betrayal. 🤬

And now I’m mad all over again. 🥲💊

Jerian Lewis

January 17, 2026 AT 08:32Just because it’s the same pill doesn’t mean it’s the same experience. My body reacted differently to the authorized generic of my blood pressure med. Same ingredients. Different fillers. I had dizziness for two weeks. I switched back. My doctor didn’t even know it was an authorized generic. No one told me.

So yes, it’s the same. But your body doesn’t care about FDA classifications. It cares about what it feels.

Transparency isn’t optional. It’s medical ethics.