When you pick up a prescription, you might not think about how much it costs the healthcare system-or whether there’s a cheaper version that works just as well. But behind every pill, there’s a complex calculation: cost-effectiveness analysis (CEA). This isn’t just a financial exercise. It’s about making sure patients get the care they need without wasting billions of dollars. And when it comes to generic drugs, this analysis reveals some startling truths.

Why Generics Aren’t All Created Equal

You’ve probably heard that generics are cheaper than brand-name drugs. That’s true-but not always. Some generic versions of the same drug cost ten times more than others. A 2022 study in JAMA Network Open looked at the top 1,000 generic drugs in the U.S. and found that 45 of them were being sold at prices 15.6 times higher than other drugs in the same therapeutic class. One drug, for example, cost $380 a month, while a clinically identical alternative cost just $24. That’s not a pricing mistake. That’s a system failure. The reason? It’s not about quality. It’s about market structure. When a brand-name drug loses patent protection, multiple manufacturers can start making the same pill. Prices should crash. And they usually do. The FDA says the first generic competitor brings prices down by about 39%. With six or more competitors, prices fall more than 95% below the original brand price. But here’s the catch: not all generics enter the market at the same time. Some manufacturers delay entry. Others charge more because they know insurers and pharmacies are slow to switch.How Cost-Effectiveness Analysis Actually Works

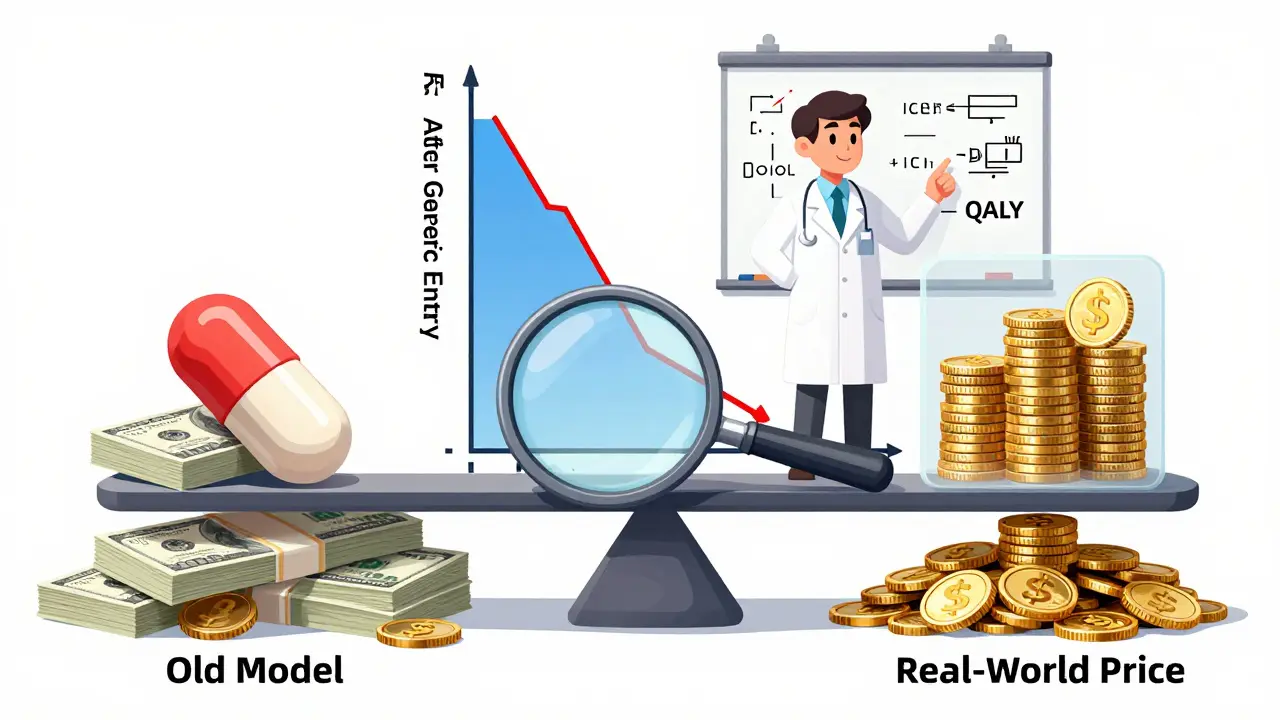

CEA doesn’t just compare prices. It compares value. The standard metric is the incremental cost-effectiveness ratio (ICER)-how much extra money you spend to gain one additional quality-adjusted life year (QALY). A QALY accounts for both how long someone lives and how well they live. If a drug costs $10,000 more than another but extends life by one year with good quality, its ICER is $10,000 per QALY. For generics, this gets messy. Most published analyses ignore one critical fact: prices will drop. A 2021 ISPOR conference review found that 94% of cost-effectiveness studies on drugs didn’t even try to predict what prices would look like after generics entered the market. That’s like forecasting a car’s fuel efficiency without considering it’ll be on sale next year. If you assume a drug will stay expensive forever, you’ll wrongly conclude it’s not cost-effective-even if a cheaper version is just months away. The VA Health Economics Resource Center gives a clearer picture. They adjust prices based on real-world data: brand-name drugs are priced at 64% of Average Wholesale Price (AWP), while generics are priced at just 27% of AWP. That’s not a guess. It’s based on what hospitals and clinics actually pay. When you use these numbers, the value of generics becomes obvious.

The Hidden Cost of Not Switching

Imagine a patient on a $500-a-month generic medication. There’s another generic version of the same drug-same active ingredient, same dosage, same FDA approval-that costs $25. If you switch 10,000 patients, you save $50 million a year. That’s not theoretical. That’s exactly what happened in the JAMA study. The 45 high-cost generics they identified cost $7.5 million collectively. Switching to the cheaper alternatives would have cut that to $873,711. Savings of nearly 90%. But why don’t insurers switch? The answer lies with Pharmacy Benefit Managers (PBMs). These middlemen negotiate prices between drugmakers and insurers. They profit from the gap between what they pay pharmacies and what they charge insurers. That’s called “spread pricing.” If a PBM gets $400 for a $25 drug, they make $375 per prescription. They have no incentive to switch to the cheaper option. In fact, they benefit from keeping expensive generics on formularies. This isn’t a glitch. It’s a business model. And it’s why patients end up paying more-through higher premiums, deductibles, or copays-even when cheaper options exist.Who’s Doing It Right?

Europe has been using formal CEA for decades. Over 90% of health technology assessment agencies there use cost-effectiveness data to decide which drugs to cover. The U.S. is behind. Only 35% of commercial insurers routinely use CEA in their coverage decisions, according to a 2022 AMCP survey. Medicare Part D doesn’t require it at all. Some organizations are changing that. The Institute for Clinical and Economic Review (ICER) publishes detailed, transparent reports on drug value. They don’t just look at current prices. They model what prices will be after generic entry. They factor in patent cliffs, manufacturing capacity, and competition timelines. Their work is public. Their methods are open. And they’ve helped shift formularies toward lower-cost generics. The NIH’s 2023 framework for CEA now explicitly says: “Generic and biosimilar versions of comparators become available.” That’s a game-changer. It means future analyses won’t ignore the future. They’ll build in expected price drops. That’s how you make decisions that save money and improve care.The Bigger Picture: Billions at Stake

Generic drugs make up 90% of all prescriptions in the U.S. But they account for only 17% of total drug spending. That’s because they’re cheap. The FDA estimates that generics saved the healthcare system $1.7 trillion between 2007 and 2017. That’s more than the entire GDP of Poland. And it’s only going to grow. Over 300 small-molecule drugs will lose patent protection between 2020 and 2025. But here’s the problem: if we keep using outdated cost models that ignore generic competition, we’ll miss the chance to save even more. We’ll keep paying $300 for a drug that should cost $15. We’ll let PBMs profit from the gap. We’ll let patients suffer from higher out-of-pocket costs. The solution isn’t more regulation. It’s better analysis. CEA that accounts for real market dynamics. That means:- Modeling future generic entry, not just current prices

- Comparing not just brand vs. generic, but generic vs. generic

- Exposing spread pricing and its impact on formulary decisions

- Adopting transparent, public CEA models like ICER’s

What You Can Do

If you’re a patient, ask your pharmacist: “Is there a cheaper version of this drug?” If you’re a clinician, check your formulary for therapeutic alternatives. If you’re an insurer or employer, demand that your PBM show you the real cost differences between generics. Don’t accept “it’s the same drug” as a reason to pay more. The data is clear. The tools exist. The savings are massive. The only thing missing is the will to use them.What is cost-effectiveness analysis (CEA) for generic drugs?

Cost-effectiveness analysis (CEA) for generic drugs compares the cost of different treatment options to the health outcomes they produce. It uses metrics like the incremental cost-effectiveness ratio (ICER)-how much more you pay to gain one quality-adjusted life year (QALY). For generics, CEA helps determine whether switching from a high-priced generic to a lower-priced alternative with the same active ingredient delivers better value for patients and payers.

Why are some generic drugs so expensive?

Some generic drugs remain expensive because of market distortions, not quality. When a brand-name drug loses patent protection, multiple manufacturers can produce the same drug. But not all enter the market at once. Some delay entry to avoid price wars. Others charge more because Pharmacy Benefit Managers (PBMs) profit from the price gap between what they pay pharmacies and what insurers pay-called "spread pricing." This keeps high-cost generics on formularies even when cheaper alternatives exist.

How much money can be saved by switching to cheaper generics?

A 2022 study in JAMA Network Open found that replacing 45 high-cost generics with lower-cost therapeutic alternatives saved nearly 90% in spending-reducing total costs from $7.5 million to just $873,711. In some cases, identical drugs from different manufacturers varied in price by over 20 times. The FDA estimates that generics saved the U.S. healthcare system $1.7 trillion from 2007 to 2017.

Do most cost-effectiveness studies account for future generic price drops?

No. A 2021 ISPOR conference review found that 94% of published cost-effectiveness analyses failed to account for future generic entry. This leads to flawed conclusions, where expensive drugs are wrongly deemed cost-effective because the analysis assumes they’ll stay expensive forever. Leading agencies like NIH and ICER now recommend modeling expected price declines after patent expiration.

How do Pharmacy Benefit Managers (PBMs) affect generic drug pricing?

PBMs profit from "spread pricing"-the difference between what they pay pharmacies for a drug and what they charge insurers. If a generic drug costs $25 at the pharmacy but the PBM charges the insurer $400, they pocket $375 per prescription. This creates a financial incentive to keep high-cost generics on formularies, even when cheaper, equally effective alternatives exist. This practice distorts cost-effectiveness analysis and drives up overall drug spending.

Skilken Awe

February 14, 2026 AT 17:54Let me get this straight - we’ve got a system where the same damn pill costs $380 one place and $24 another, and the middlemen are literally getting rich off the difference? That’s not a market failure. That’s a crime scene with a PowerPoint presentation.

Pharmacy Benefit Managers aren’t ‘negotiating’ - they’re running a tollbooth on life-saving medication. And we call this ‘healthcare’? I’ve seen more ethical behavior from a pickpocket at a bus station.

94% of cost-effectiveness studies ignore generic price drops? That’s not ignorance. That’s complicity. You’re not doing analysis - you’re doing damage control for the corporate overlords who built this mess. And you wonder why people don’t trust the system?

ICER’s models are the only thing standing between this circus and total collapse. The rest of you? You’re just rearranging deck chairs on the Titanic while the PBM CEOs take the lifeboats.

And don’t even get me started on how Medicare Part D refuses to use CEA. That’s not policy. That’s a taxpayer-funded heist with a stamp of approval.

Steve DESTIVELLE

February 15, 2026 AT 14:55When we speak of cost effectiveness we must first ask what is cost and what is effectiveness for cost is not merely monetary for effectiveness is not merely biological for the human being is not a machine nor a spreadsheet nor a balance sheet

When a man takes a pill that costs twenty five dollars instead of three hundred eighty he does not merely save money he saves dignity he saves autonomy he saves the quiet morning when he can breathe without counting pennies

The market has forgotten the soul of healing and replaced it with spreadsheets that weep in silent excel sheets and no one hears them

Generics are not commodities they are echoes of the same truth repeated by different hands and yet we punish the echo for not sounding like the original scream

Perhaps we are not failing at cost analysis we are failing at humanity

Stephon Devereux

February 17, 2026 AT 04:39There’s so much hope in this conversation if we just stop treating healthcare like a corporate boardroom and start treating it like a public good.

Look - the math is absurdly simple. If a drug has the same active ingredient, same dosage, same FDA approval, and costs 15x less - switching isn’t just smart, it’s a moral obligation.

And the fact that PBMs profit from the gap? That’s not a loophole. That’s a backdoor into a broken system. We need to ban spread pricing outright. Not regulate it. Ban it.

ICER’s approach? That’s the blueprint. Transparent. Data-driven. Future-aware. We need every insurer, every hospital, every pharmacy to adopt this. Not as a suggestion. As a requirement.

The NIH’s new framework is a game-changer. It finally acknowledges reality: prices drop. Competitors enter. Markets work. Why did it take this long?

And to patients: yes, ask your pharmacist. Ask twice. Ask until they get annoyed. That’s your power. That’s how change starts - one question at a time.

athmaja biju

February 17, 2026 AT 19:17USA thinks it leads the world in innovation but in reality it leads in corruption disguised as healthcare

Other nations use CEA to save lives and money but here we use it to justify why a man in a suit gets $375 profit on a $25 pill

How can a country that sends rockets to Mars not fix a system where a diabetic pays $500 for insulin when $25 exists?

This is not capitalism. This is feudalism with a corporate logo.

India has 1.4 billion people and we produce 40% of the world’s generics - yet we see this madness happening in the land of the free?

It’s not a failure of science. It’s a failure of ethics. And ethics is the one thing America forgot when it sold its soul to Wall Street.

Reggie McIntyre

February 18, 2026 AT 05:56I love how this whole thing is basically a superhero movie where the real villain isn’t some evil CEO - it’s inertia.

Imagine if we treated drug pricing like we treat video game updates - ‘Hey, there’s a cheaper version that does the same thing? Oh sweet, let’s patch in the new one!’

But nope. We’re stuck in 2005 with formularies that haven’t been updated since the dinosaurs were still getting patents.

ICER is like the wise old wizard who actually read the manual. Meanwhile everyone else is still trying to figure out how to turn the console on.

And PBMs? They’re the glitch in the system that keeps spawning infinite money. You kill one, two more pop up.

But here’s the good news - the tools exist. The data is out there. We just need to stop pretending this is complicated. It’s not. It’s just inconvenient for the people who profit from the chaos.

Jack Havard

February 19, 2026 AT 22:12Everyone’s acting like this is some new revelation. It’s not.

The FDA’s numbers? Overstated. The JAMA study? Cherry-picked. ICER? Funded by the same NGOs that hate pharmaceuticals.

Maybe the $380 version has better fillers. Maybe the $24 one has inconsistent bioavailability. Maybe the manufacturers have different supply chains. You don’t know. No one does.

And why are we assuming generics are always interchangeable? Because the FDA says so? That’s like trusting a weatherman who’s been wrong 70% of the time.

Also - PBMs aren’t the villains. They’re responding to incentives. If you pay them to keep expensive drugs on formularies, they will. That’s not evil. That’s capitalism.

Stop looking for villains. Look at systems. And stop pretending this is solvable without massive regulatory overreach that will only make things worse.

Gloria Ricky

February 20, 2026 AT 02:35Stacie Willhite

February 20, 2026 AT 04:02I’ve been on a generic for years. I didn’t know there was a version that cost 1/15th of what I was paying.

I didn’t ask because I assumed my doctor and my insurance had already picked the best option.

It’s terrifying how little control we have - even over something as basic as the pill we swallow every day.

I’m not mad at the system. I’m just… tired. Tired of being told it’s "the same drug" while my deductible keeps climbing.

Thank you for saying this out loud. I didn’t know I needed to hear it.

Jason Pascoe

February 21, 2026 AT 21:47Interesting how the U.S. lags behind Europe on this. I work in public health down under - we’ve been using similar frameworks for over a decade.

The key isn’t just the numbers. It’s transparency. When everyone can see how a decision was made - insurers, prescribers, patients - you reduce the room for manipulation.

And honestly? The real win isn’t just the savings. It’s the trust. When patients know their care is being guided by evidence, not profit margins, they engage more. They stick with treatment. They get better.

It’s not rocket science. It’s just… consistent, honest policy. We’ve done it. Others can too.

Sonja Stoces

February 23, 2026 AT 08:53they're already using predictive models to deny care. this "transparency" is just the velvet glove before the iron fist.

and don't get me started on how ICER is secretly funded by Big Pharma through "nonprofit" think tanks. #DeepStateHealthcare